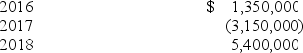

In its first three years of operations Sharp Chairs reported the following operating income (loss) amounts:  There were no deferred income taxes in any year. In 2017, Sharp elected to carry back its operating loss. The enacted income tax rate was 35% in 2016 and 40% thereafter. In its 2018 balance sheet, what amount should Sharp report as current income tax payable?

There were no deferred income taxes in any year. In 2017, Sharp elected to carry back its operating loss. The enacted income tax rate was 35% in 2016 and 40% thereafter. In its 2018 balance sheet, what amount should Sharp report as current income tax payable?

Definitions:

Price Elastic

Relating to the responsiveness of the demand or supply of a good or service to changes in its price.

Price Elasticity

A measure of the responsiveness of the quantity demanded or supplied of a good or service to a change in its price.

Quantity Demanded

The total amount of a good or service that consumers are willing and able to purchase at a given price level.

Inelastic

A description of a situation where the demand or supply for a good or service is relatively unresponsive to changes in price.

Q24: Identify the three common forms of business

Q65: The corporate charter of Llama Co. authorized

Q129: The Model Business Corporation Act:<br>A) Uses the

Q130: The effect of a change in tax

Q130: 1) In a lease transaction, what are

Q135: Vested benefit obligation<br>A)Future compensation levels estimated.<br>B)Not contingent

Q143: When treasury shares are sold at a

Q165: At the beginning of 2016, Emily Corporation

Q182: On January 1, 2018, Tennessee Valley Corporation

Q261: Discuss the three major types of leases