In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

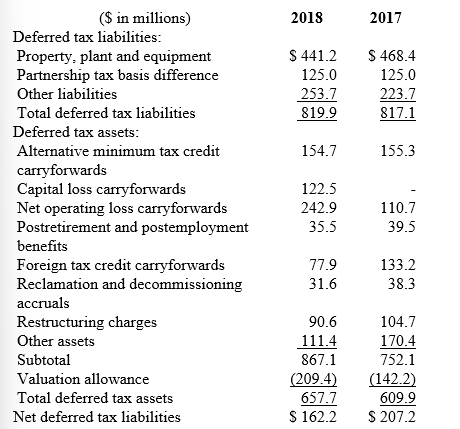

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Indicate why LMC lists net operating loss carryforwards as a component of deferred tax assets.

Definitions:

Prosimians

A group of primates that includes lemurs, lorises, and tarsiers, often characterized by their nocturnal habits and reliance on smell.

Allogrooming

The practice among animals of grooming each other, which serves social bonding and hygiene purposes.

Concealed Ovulation

A phenomenon in some species where there are no obvious visible signs to males when the female is fertile.

Primates

An order of mammals that includes humans, apes, monkeys, and prosimians, characterized by large brains, forward-facing eyes, and dexterous hands.

Q3: <br>Required:<br>Round your answers to the nearest whole

Q24: Identify the three common forms of business

Q41: A statement of comprehensive income does not

Q59: Nickle leased equipment to Back Company on

Q71: On January 1, 2018, Red, Inc. borrowed

Q101: If the lessee is expected to take

Q134: Retained earnings<br>A)May be increased when net income

Q168: Discount on bonds<br>A)Market rate higher than stated

Q227: On January 1, 2018, Wellburn Corporation leased

Q230: Assuming that Auerbach issued the bonds for