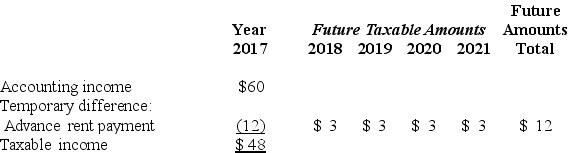

The following information is for James Industries' first year of operations. Amounts are in millions of dollars.  In 2018 the company's pretax accounting income was $67. The enacted tax rate for 2017 and 2018 is 40%, and it is 35% for years after 2018.

In 2018 the company's pretax accounting income was $67. The enacted tax rate for 2017 and 2018 is 40%, and it is 35% for years after 2018.

Required:

Prepare a journal entry to record the income tax expense for the year 2018. Show well-labeled computations for income tax payable and the change in the deferred tax account.

Definitions:

Extraversion

A personality trait characterized by sociability, talkativeness, and a high level of engagement with the external world.

Approach Motivation

The driving force that prompts individuals toward positive stimuli or outcomes, as opposed to avoiding negative ones.

Intrinsic Goals

Objectives that are pursued for their own sake, driven by an inherent interest or enjoyment in the task, rather than external rewards.

Universal Needs

Fundamental requirements or desires common to all human beings, such as food, safety, and belonging.

Q20: Use I = Increase, D = Decrease,

Q57: Liberty Company issued 10-year bonds at 105

Q68: Recognizing tax benefits in a loss year

Q81: What was the PBO at the

Q84: Franklin's taxable income ($ in millions) is:<br>A)

Q91: The December 31, 2018, balance sheet of

Q102: Bond X and bond Y both are

Q138: In 2017, HD had reported a deferred

Q164: Which of the following circumstances creates a

Q218: On June 30, 2018, Hercule, Inc. leased