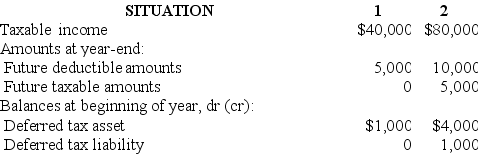

Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:  The enacted tax rate is 40% for both situations.

The enacted tax rate is 40% for both situations.

Required:

For each situation determine the:

(a.) Income tax payable currently.

(b.) Deferred tax asset - balance at year-end.

(c.) Deferred tax asset change dr or (cr) for the year.

(d.) Deferred tax liability - balance at year-end.

(e.) Deferred tax liability change dr or (cr) for the year.

(f.) Income tax expense for the year.

Definitions:

Blue-Sky Laws

State securities laws designed to protect investors from fraudulent sales practices and securities offerings.

State Securities Laws

State securities laws, also known as "Blue Sky Laws," are regulations at the state level designed to protect investors against fraud and to regulate the sale and offering of securities.

Federal Law

Legislation enacted by the national government of a country.

Filing Of Shares

The process of registering shares with regulatory authorities, often related to the issuance of new shares or the meeting of disclosure requirements for public companies.

Q4: If the underlying asset is of such

Q36: A reconciliation of pretax financial statement income

Q98: If the lessor records deferred rent revenue

Q110: Which of the following differences between financial

Q124: What is comprehensive income and how does

Q166: In this situation, Reagan:<br>A) is the lessee

Q210: The employer has an obligation to provide

Q249: Required:<br>Consider this to be an operating lease.

Q251: J Corp. is a lessee that entered

Q261: Discuss the three major types of leases