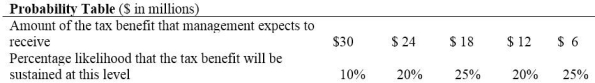

Brook Company has taken a position on its tax return to claim a tax credit of $30 million (direct reduction in taxes payable) and has determined that its sustainability is "more likely than not" based on its technical merits. Brook's management has developed the probability table shown below of all possible material outcomes:  Brook's taxable income is $300 million for the year, and its effective tax rate is 40%. The tax credit would be a direct reduction in current taxes payable.

Brook's taxable income is $300 million for the year, and its effective tax rate is 40%. The tax credit would be a direct reduction in current taxes payable.

Required:

1. At what amount would Brook measure the tax benefit in its income statement?

2. Prepare the appropriate journal entry for Brook to record its income taxes for the year.

Definitions:

Excessive Eating

Consuming food in amounts significantly greater than what is required for normal nutrition and energy, often leading to physical and psychological health issues.

Syrupy Liquid

A thick, viscous liquid often sweet in nature, resembling syrup.

Morphine Withdrawal

A series of symptoms that occur when a person stops using morphine after becoming physically dependent on the substance.

Aggressive

Characterized by or resulting from a tendency to attack, confront, or compete with others.

Q11: At December 31, 2017, Mallory, Inc., reported

Q26: For companies that prepare their financial statements

Q44: Plan assets<br>A)Future compensation levels estimated.<br>B)Not contingent on

Q93: Some preferred stock is cumulative while other

Q104: In accounting for an operating lease, describe

Q156: What is the total effective interest paid

Q164: Scottie Adams Bird Supplies issued 10% bonds,

Q190: EPBO<br>A)The portion of the EPBO attributed to

Q212: The balance of the plan assets can

Q244: Gains and losses can occur with pension