Use the following to answer questions

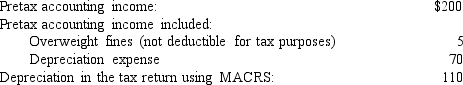

The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars) :

The applicable tax rate is 40%.There are no other temporary or permanent differences.

The applicable tax rate is 40%.There are no other temporary or permanent differences.

-Franklin's balance sheet at the end of its first year would report:

Definitions:

Interfering

The act of impeding or meddling in the affairs or processes of others, potentially causing disruption or hindrance.

Choice Decisions

The cognitive process of selecting among multiple options or actions in various contexts.

Government Intervention

The active involvement of a government in the economic, social, or political matters of a country, typically to correct market failures or promote social welfare.

Black Market

An illegal trade of goods or services where transactions occur beyond governmental control or are not sanctioned by law.

Q7: Treasury shares are most often reported as:<br>A)A

Q21: GAAP regarding accounting for income taxes requires

Q24: Consider the following: I. Present value of

Q45: How are deferred tax assets arising from

Q63: Explain why LMC has a $209.4 million

Q92: Clark's Chemical Company received customer deposits on

Q92: When bonds are sold at a discount

Q95: The classification of deferred tax assets is

Q126: Why did the loss result in a

Q187: Investors should be wary of stock buybacks