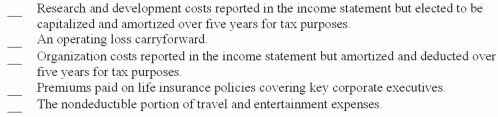

Listed below are five independent situations. For each situation indicate (by letter) whether it will create (A) a deferred tax asset, (L) a deferred tax liability, or (N) neither.

Definitions:

Working Memory Capacity

The amount of information a person can hold and manipulate in their working memory at one time.

Mental Processes

are activities of the mind involved in thinking, understanding, learning, and remembering.

Executive Control Functions

Cognitive processes including planning, working memory, attention, problem solving, verbal reasoning, inhibition, mental flexibility, task switching, and initiation and monitoring of actions.

Practical Intelligence

A form of intelligence related to the ability to solve everyday problems by utilizing experience-based knowledge.

Q9: Which of the following statements regarding guaranteed

Q27: Under IFRS, a liability that is refinanced

Q67: Listed below are five independent situations. For

Q78: If a company's deferred tax asset is

Q97: Python Company leased equipment from Hope Leasing

Q104: The attribution period for postretirement benefits spans

Q105: Franklin's balance sheet at the end of

Q110: On January 1, 2013, Ozark Minerals issued

Q119: Ignoring operating expenses and additional sales in

Q140: Sunnyvale Computer Company sells a line of