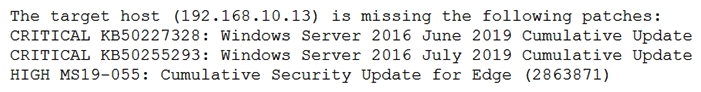

A security analyst is evaluating two vulnerability management tools for possible use in an organization. The analyst set up each of the tools according to the respective vendor's instructions and generated a report of vulnerabilities that ran against the same target server. Tool A reported the following:  Tool B reported the following:

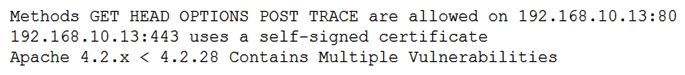

Tool B reported the following:  Which of the following BEST describes the method used by each tool? (Choose two.)

Which of the following BEST describes the method used by each tool? (Choose two.)

Definitions:

Government Bonds

Long-term debt of the federal government.

Commercial Bank Reserves

Funds that commercial banks are required to hold in reserve against deposits, either as cash in their vaults or as deposits with the central bank.

Reserve Ratio

The portion of depositors' balances that banks must have on hand as cash, as required by central banking regulations.

Discount Rate

The interest rate charged to commercial banks and other financial institutions for the loans they take from the central bank or Federal Reserve.

Q16: An organization determines it cannot go forward

Q29: Which of the following sources would a

Q67: Designing a system in which only information

Q93: A security analyst has received reports of

Q97: Which of the following services would restrict

Q235: A SaaS customer reports that no one

Q241: When designing a new private cloud platform,

Q273: A manufacturing company's current security policy mandates

Q298: A systems administrator has deployed the latest

Q348: While investigating suspicious activity on a server,