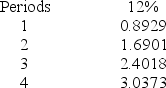

Vextra Corporation is considering the purchase of new equipment costing $35,000.The projected annual cash inflow is $11,000,to be received at the end of each year.The machine has a useful life of 4 years and no salvage value.Vextra requires a 12% return on its investments.The present value of an annuity of $1 for different periods follows:

-What is the net present value of the machine?

Definitions:

Plant and Equipment

Plant and equipment are tangible assets used in the production or supply of goods and services, such as machinery, vehicles, and buildings, necessary for business operations.

Accumulated Depreciation

Sum of all depreciation expenses allocated to a fixed asset since it first became operational.

Mortgage Payable

A liability account showing amount owed on a mortgage.

Liquidity

A measure of the ease with which an asset can be converted into cash without significant loss in value.

Q16: A capital deficiency means that:<br>A)The partnership has

Q20: The _ principle requires that the benefits

Q33: A company has the choice of either

Q54: What is the net present value of

Q76: The payback method,unlike the net present value

Q78: Incremental costs are the additional costs incurred

Q88: If a partner withdraws from a partnership

Q94: Minor Electric has received a special one-time

Q102: McCartney,Harris,and Hussin are dissolving their partnership.Their partnership

Q167: Return on investment is a useful measure