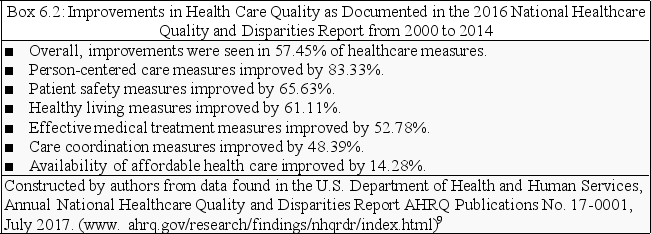

Box 6.2 provides data on quality improvements in general from 2000 to 2014. Analyze the data using the percentage difference computations you learned in Chapter 5 in order to answer questions 8 - 10.

-The above finding demonstrates:

Definitions:

Beta

A measure of a stock's volatility in relation to the overall market; a beta greater than 1 indicates higher risk and potential return, while a beta less than 1 implies less risk and return.

Cost of Debt

The effective rate that a company pays on its current debt, including loans, bonds, and any other form of debt.

Cost of Equity

The theoretical earnings paid by a business to its equity holders as compensation for the risk they take by investing.

Preferred Stock

A class of ownership in a corporation that has a higher claim on its assets and earnings than common stock, often paying fixed dividends.

Q6: According to recent surveys by the American

Q10: Rationing does not seem to exist in

Q15: When providers award discounts to Blue Cross

Q15: A researcher is brainstorming terms for a

Q15: Based upon the Study Guide/PowerPoints, data serves

Q22: At least some findings from the analysis

Q22: Which component or components of the health

Q28: Based upon your own reflections, do you

Q55: When released, this substance is instrumental in

Q87: The link between stress and inflammation is