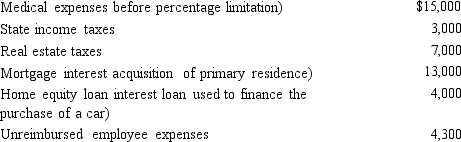

Mitch, who is single and age 46 and has no dependents, had AGI of $100,000 this year.His potential itemized deductions were as follows.  What is the amount of Mitch's AMT adjustment for itemized deductions for 2018?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2018?

Definitions:

Power Motive

A psychological term referring to an individual's desire to exert control or influence over others.

Testosterone

A steroid hormone associated with the development of male secondary sexual characteristics, muscle mass, and bone density, also affecting mood.

Amygdala

A section of the brain's limbic system involved in emotion processing, fear response, and behavior regulation.

Neuroticism

A personality trait characterized by emotional instability, anxiety, moodiness, worry, and envy.

Q21: Ten years ago, Carrie purchased 2,000 shares

Q27: During the year, Green, Inc., incurs the

Q34: In the sale of a partnership, how

Q55: Tamara operates a natural gas sole proprietorship

Q55: Yolanda owns 60% of the outstanding stock

Q60: On January 14, Edamame Industries purchased supplies

Q80: Goolsbee, Inc., a U.S.corporation, generates U.S.-source and

Q86: In the current tax year, Ben exercised

Q91: Dott Corporation generated $300,000 of state taxable

Q115: Which of the following statements regarding income