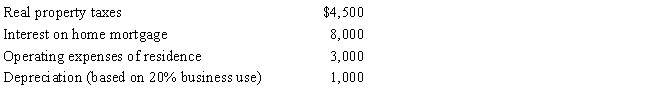

Rocky has a full-time job as an electrical engineer for the city utility. In his spare time, Rocky repairs TV sets in the basement of his personal residence. Most of his business comes from friends and referrals from former customers, although occasionally he runs an ad in the local suburbia newspaper. Typically, the sets are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.The floor space of Rocky's residence is 2,500 square feet, and he estimates that 20% of this is devoted exclusively to the repair business (i.e., 500 square feet). Gross income from the business is $13,000, while expenses (other than home office) are $5,000. Expenses relating to the residence are as follows:

What is Rocky's net income from the repair business

a.If he uses the regular (actual expense) method of computing the deduction for office in the home?

b.If he uses the simplified method?

Definitions:

Rate Of Return

A measure of the profitability of an investment, calculated as a percentage of the original investment.

Net Value

The difference between the total benefits and total costs associated with an economic activity or transaction.

Long Run Deficit

A fiscal situation where a government consistently spends more than it earns over an extended period, leading to sustained budget deficits.

Q23: Statutory employees:<br>A)Report their expenses on Form 2106.<br>B)Include

Q37: Sadie mailed a check for $2,200 to

Q39: A purchased trademark is a § 197

Q47: A physician recommends a private school for

Q48: Unless circulation expenditures are amortized over a

Q55: In 2017, Boris pays a $3,800 premium

Q81: Austin, a single individual with a salary

Q85: Why is there no AMT adjustment for

Q99: Paula is the sole shareholder of Violet,

Q105: Realizing that providing for a comfortable retirement