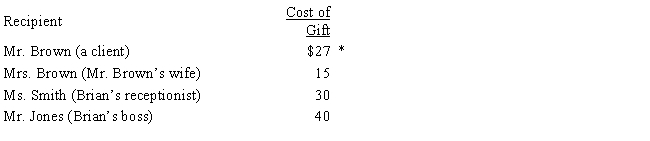

Brian makes gifts as follows:

* Includes $2 for gift wrapping

* Includes $2 for gift wrapping

Presuming adequate substantiation and no reimbursement, how much may Brian deduct?

Definitions:

Brain Activity

The electrical and biochemical processes occurring in the brain that facilitate cognitive functions, emotions, and behaviors.

Self-cueing

A technique used by individuals to remind themselves of tasks or actions, often to support memory or attention.

Entrepreneurial Behavior

Actions and practices that demonstrate initiative, risk-taking, and innovation in starting or managing a business.

Awareness

The knowledge or perception of a situation or fact, often used in context with social, environmental, or personal issues.

Q4: Identify from the list below the type

Q9: Which of the following statements regarding differences

Q21: Alice incurs qualified moving expenses of $12,000.

Q24: During 2017, Eva used her car as

Q73: Prior to the effect of the tax

Q81: Lavender, Inc., incurs research and experimental expenditures

Q85: Dan contributed stock worth $16,000 to his

Q89: Percentage depletion enables the taxpayer to recover

Q93: For a vacation home to be classified

Q149: Section 212 expenses that are related to