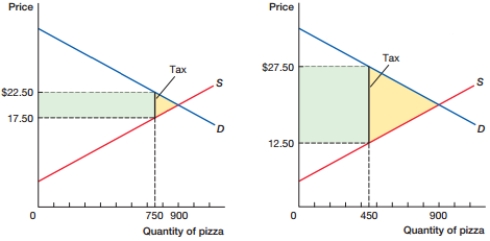

(Figure: Changing Tax Rates Alpha) In the figure, suppose that the tax rate is changed so that the market moves from the graph on the left to the graph on the right. This change would likely:

Definitions:

Dividends

Funds disbursed by a company to its shareholders, representing a share of the profits earned by the company.

Total Liabilities

The sum of all financial obligations a company owes to outside parties.

Expenses

Costs incurred by a business in the process of earning revenue, including operational costs, salaries, and utilities.

Retained Earnings

Part of a company's profit that is held or retained and saved for future use, reinvestment, or to pay debt rather than being paid out as dividends to shareholders.

Q16: (Figure: An Excise Tax on Sellers) In

Q17: The Moonlight Corporation conducts most of its

Q21: Tyrone has $45,000 in income. The marginal

Q26: A foreign firm operates in a country

Q37: In a fiscal year when the government

Q49: Regarding the circular flow model, _ is

Q51: A positive externality exists, which leads the

Q60: When prices increase, what happens to producer

Q63: A corporation has 2 million shares of

Q99: _ profit is total revenue minus implicit