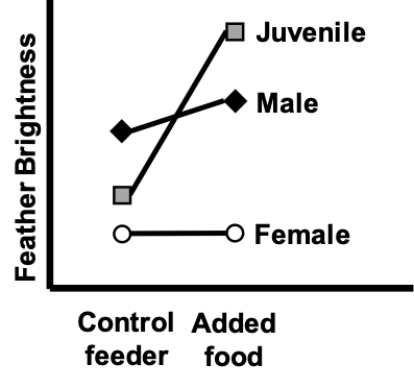

The interaction plot shown most likely represents which of the following?

Definitions:

Depreciation

The process of allocating the cost of a tangible asset over its useful lifespan, representing wear and tear, deterioration, or obsolescence.

Section 1250

Section 1250 of the U.S. Internal Revenue Code deals with the tax treatment of gains from the sale of depreciable real property, distinguishing between ordinary income and capital gains.

Short-term Loss

A financial loss realized on the sale or exchange of an asset held for one year or less.

Accumulated Straight-line Depreciation

The total amount of depreciation expense that has been recorded for an asset to date, using the straight-line method of depreciation.

Q8: What proportion of individuals in the experiment

Q11: Using the data set shown, calculate

Q12: Consider a data sample consisting of 12

Q26: Describe how and why we can use

Q29: Sampling error is defined as differences between

Q36: Internal audit… Please select all that apply.<br>A)

Q39: Consider a sample of foxes in which

Q40: To determine whether there appears to be

Q43: Full body scans are becoming popular even

Q48: Using the Bonferroni correction reduces our overall