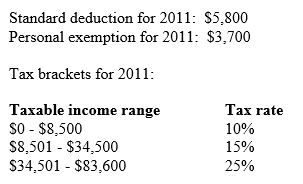

Bang Nguyen recently graduated from college and started working in a good job. He has a little money invested in a stock that pays no dividends. He lives in an apartment, is single, and has no dependents. He has a $22,000 student loan balance and he paid $600 interest in 2011. He is considering going back to school part-time for some additional computer classes. He does not have a personal IRA and he contributed 2% of his $38,750 salary to his 401K plan at work for 2011. He is just completing his tax return for 2011. Based on the information below, answer the following questions.

-What is Bang's taxable income for 2011?

Definitions:

Resources Denied

Situations where access to necessary or desired resources is restricted or not granted.

High Anger

High Anger denotes an intense level of anger, which could affect interpersonal interactions and decision-making processes negatively.

Low Compassion

Describes a situation or individual displaying a minimal level of empathy and understanding towards others' circumstances or feelings.

Joint Gains

Benefits or advantages that are mutually achieved by parties in a negotiation or collaboration, resulting in a win-win situation.

Q1: When you are considering different investment options

Q5: A savings alternative that pays a fixed

Q12: What is Bang's marginal tax rate for

Q23: What is the name of the formal

Q56: Joshua recently purchased a new home. His

Q63: You have been saving for five years

Q66: Assets that you purchase for the purpose

Q71: What is not a benefit normally associated

Q83: Credit card insurance is usually unnecessary since

Q151: As a general rule, your PITI shouldn't