Use This Information to Answer the Following Questions -Use the Sensitivity Report to Answer the Following Questions:

A

Use this information to answer the following questions.

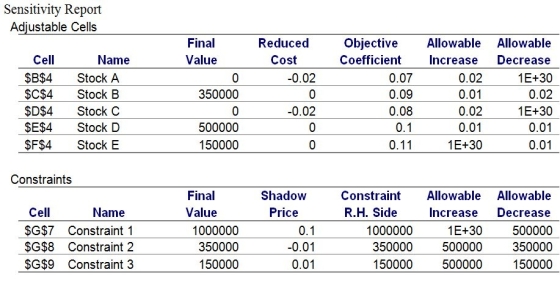

An investment company currently has $1 million available for investment in five different stocks.The company wants to maximize the interest earned over the next year.The five investment possibilities along with the expected interest earned are shown below.To manage risk,the investment firm wishes to have at least 35% of the investment in stocks A and B.Furthermore,no more than 15% of the investment may be in stock E.

-Use the Sensitivity Report to answer the following questions:

a.What would be the impact on the optimal allocation if the expected interest earned on stock A decreases to 6%?

b.What would be the impact on the optimal allocation if the expected interest earned on stock A increases to 10%?

c.What should the minimal expected interest earned for stock C be before it would be desirable to invest in this particular stock?

d.What would be the impact on the optimal allocation and the objective function value if the expected interest earned on stock B decreases by 1%?

Definitions:

Mugwumps

A political movement in the United States during the late 19th century, characterized by reform-minded members who left the Republican Party for the Democratic Party.

Political Party

An organized group of people with shared political beliefs and goals, aiming to influence or control government policy and actions through the election of its members to public office.

Gilded Age

A term often used to describe the late 19th century in the United States, a period marked by rapid industrialization, economic growth, and ostentatious displays of wealth, alongside deep social inequalities.

Party Politics

The politics and policies promoted by political parties as they compete for control of government offices and influence over governmental decisions.

Q1: A goal programming problem assumes that its

Q7: According to reinforcement theory, the response is

Q13: A company must decide whether to build

Q18: It can be inferred from an integrative

Q18: Unbounded linear programming problems typically arise as

Q18: Refer to the information above.Suppose that the

Q23: The ABC Corporation is considering introducing a

Q45: A multiphase queuing system is one in

Q48: An isoprofit line represents a line whereby

Q56: An iterative group process that allows experts,who