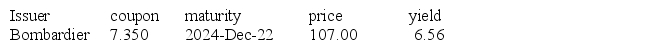

Given the following bond information:

What would be the taxable income on this bond if it were purchased at this price on December 20th and sold a year later for a price of 103.00? Assume face value of $10 000 and a semi-annual coupon payment.

Definitions:

Inventory Purchases

Transactions involving buying goods to be sold in the normal course of business, typically counted as a current asset.

Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs attributable to the production of the goods sold by a company, including material and labor costs.

Average Collection Period

The mean duration required by a business to receive payments due from its clients.

Q4: One of the advantages of no-fault automobile

Q14: If you are far from retirement age

Q17: If you purchased a bond on August

Q20: What rate of return (compounded monthly)will you

Q58: The value of the estate is calculated

Q68: The final stage in refining an IMC

Q79: The document that describes funeral preferences and

Q84: The cost of having an aide provide

Q121: The actual purchase of a product or

Q138: The push for accountability is being driven