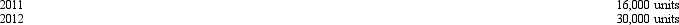

Wings Manufacturing Company purchased a new machine on July 1, 2011. It was expected to produce 200,000 units of product over its estimated useful life of eight years. Total cost of the machine was $600,000, and salvage value was estimated to be $60,000. Actual units produced by the machine in 2011 and 2012 are shown below:  Wings reports on a calendar-year basis and uses the units-of-production method of depreciation. The amount of depreciation expense for this machine in 2012 would be

Wings reports on a calendar-year basis and uses the units-of-production method of depreciation. The amount of depreciation expense for this machine in 2012 would be

Definitions:

Information Technology's Impact

Refers to the significant influence that technological advancements in information processing, storage, and dissemination have on society, businesses, and individual behavior.

Organization's Structure

The arrangement of tasks, responsibilities, and authority within an organization, dictating how activities and resources are coordinated and controlled.

The World Is Flat

A metaphorical phrase suggesting that technological advancements have leveled the competitive playing fields in global business.

Thomas Friedman

An American journalist, author, and three-time Pulitzer Prize winner known for his work on foreign affairs, global trade, the Middle East, globalization, and environmental issues.

Q10: The direct write-off method<br>A) Complies with the

Q12: Following are the account balances from Connery

Q28: An agreement that grants the owner the

Q32: Whiting Company purchased a machine in 2007

Q35: Which of these is NOT one of

Q38: Which of the following groups of control

Q49: ACE Manufacturing pays a freight bill of

Q56: Mutual fund trading costs:<br>A) are computed as

Q73: You currently have $5,000 in cash in

Q89: The process of comparing the cost of