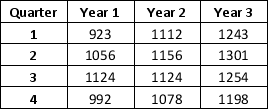

Consider the following time series:

a. Use a multiple regression model to develop an equation to account for linear trend and seasonal effects in the data. To capture seasonal effects, use the dummy variables Qtr1 = 1 if quarter 1, 0 otherwise; Qtr2 = 1 if quarter 2, 0 otherwise; Qtr3 = 1 if quarter 3, 0 otherwise; and create a variable t such that t = 1 for quarter 1 in year 1, t = 2 for quarter 2 in year 1, … ,t = 12 for quarter 4 in year 3.

a. Use a multiple regression model to develop an equation to account for linear trend and seasonal effects in the data. To capture seasonal effects, use the dummy variables Qtr1 = 1 if quarter 1, 0 otherwise; Qtr2 = 1 if quarter 2, 0 otherwise; Qtr3 = 1 if quarter 3, 0 otherwise; and create a variable t such that t = 1 for quarter 1 in year 1, t = 2 for quarter 2 in year 1, … ,t = 12 for quarter 4 in year 3.

b. Compute the quarterly forecasts for next year based on the model developed in part a.

Definitions:

Ethnocentrism

The belief that one’s ethnic group is more normal than others; an emotional source of prejudice because of people’s gut-level feelings about how right their group is—and, in turn, how wrong they think other groups are.

Attitudes

Mental states or orientations that reflect the evaluations, feelings, and propensities toward aspects of our environment, such as people, objects, and ideas.

Institutional Prejudice

Prejudice that is caused by policies in the workplace that are not intentionally set to exclude members of specific groups or to treat them differently, but which have that effect anyway.

Groupthink

A psychological phenomenon occurring within a group of people, where the desire for harmony or conformity results in an irrational or dysfunctional decision-making outcome.

Q1: Consider a sample on the waiting times

Q11: Nonbacterial gastroenteritis in adults presenting with nausea,

Q13: One minus the overall error rate is

Q15: Andrew is ready to invest $200,000 in

Q23: A constraint involving binary variables that does

Q26: The _ approach to solving integer linear

Q26: The term concordance is sometimes preferred over

Q37: A manufacturing company introduces two product alternatives.

Q43: A _ pattern exists when the data

Q49: The following questions refer to an advertisement