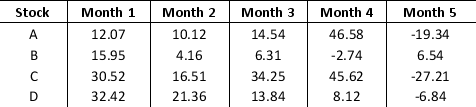

Consider the stock return data given below.

a. Construct the Markowitz portfolio model using a required expected return of at least 15 percent. Assume that the 8 scenarios are equally likely to occur.

a. Construct the Markowitz portfolio model using a required expected return of at least 15 percent. Assume that the 8 scenarios are equally likely to occur.

b. Solve the model using Excel Solver.

Definitions:

Aversive Racism

A form of racism that manifests in subtle, often unconsciously held negative feelings or beliefs about people of other races despite conscious support for equality and justice.

Egalitarian Values

Refers to the belief in the equality of all people, advocating for equal rights and opportunities without discrimination.

Minority Groups

Social groups that are marginalized, have fewer privileges, or are less powerful than the dominant segments of society.

Aversive Racist

An individual who unconsciously holds racist attitudes or feelings while consciously knowing that racism is wrong and being committed to being non-prejudiced.

Q8: Greenbell Software Inc. conducted a study on

Q8: In utilizing the collected information about the

Q9: Which of the following data patterns best

Q12: Which of the following represents the flow

Q14: The desired effect of an antidepressant drug

Q34: Consider the stock return data given below.<br>

Q38: For a maximization problem, the optimistic approach

Q40: Which of the following design guidelines, if

Q58: A toy company designs a new toy

Q60: The following table shows the average monthly