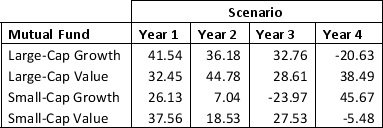

Develop a model that minimizes semivariance for the data given below with a required return of 15 percent. Define a variable ds for each scenario and let ds≥R-Rs with ds ≥ 0. Then make the objective function: Min 14s=14ds2.

Solve the model you developed with a required expected return of at least 15 percent.

Definitions:

Risky Asset

An asset that carries a higher level of financial risk when compared to safer investments, often with the potential for higher returns.

Semi-Strong Efficiency

A form of market efficiency that asserts all public information is already reflected in stock prices, making it impossible to achieve consistently higher returns.

Historical Information

Past data or records that provide context or insight into an event, individual, or institution's background.

Market Prices

The current price at which an asset or service can be bought or sold in a market, determined by the supply and demand forces.

Q1: _ is the amount by which the

Q2: A patient states that he occasionally takes

Q5: The owner of the grocery store is

Q9: The nurse is teaching an elderly man

Q15: The reduced gradient is analogous to the

Q18: Prediction of the value of the dependent

Q23: Consider the objective function,<br> <span class="ql-formula"

Q39: Starsystems is a small information systems company

Q42: Any data value with a z-score less

Q47: What do nodes in an influence diagram