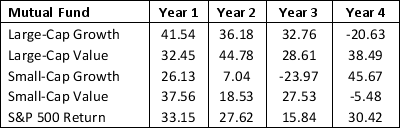

Consider the data on investment made in four types of funds and returns from S&P 500.

a. Develop an optimization model that will give the fraction of the portfolio to invest in each of the funds so that the return of the resulting portfolio matches as closely as possible the return of the S&P 500 Index. (Hint: Minimize the sum of the squared deviations between the portfolio's return and the S&P 500 Index return for each year in the data set.)

a. Develop an optimization model that will give the fraction of the portfolio to invest in each of the funds so that the return of the resulting portfolio matches as closely as possible the return of the S&P 500 Index. (Hint: Minimize the sum of the squared deviations between the portfolio's return and the S&P 500 Index return for each year in the data set.)

b. Solve the model developed in part a.

Definitions:

Issue Price

The price at which new shares are offered to the public by a corporation during an issuance.

Effective-interest Amortization

A method of amortizing the premium or discount on bonds payable that reflects the periodic interest expense based on the bond's carrying value.

Interest Expense

Expenses related to the borrowing of money by an entity during a certain period.

Issue Price

The price at which a new issue of securities is offered to the public.

Q1: Which of the following is the solution

Q5: In a linear programming model, the _

Q6: A Hispanic patient in the hospital has

Q8: In which of the following ways can

Q16: The lift ratio of an association rule

Q17: Which of the following represents the number

Q21: Television ads that are created by drug

Q50: A _ is the shadow price of

Q55: Deleting the grid lines in the table

Q57: The value of an independent variable from