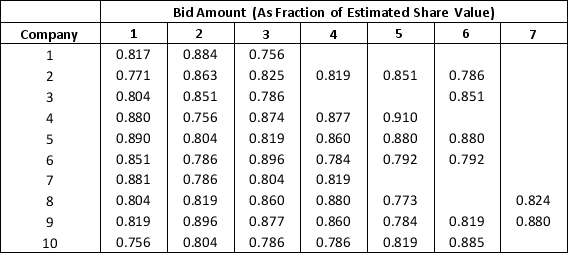

A specialty hedge fund is considering the purchase of a Jackson Pollock painting. It estimates the value of the painting to be $185 million. In an auction, both the number of competing bids and the amount of the competing bids is uncertain. The hedge fund has maintained a file summarizing 10 recent art auctions that it believes are similar to the upcoming auction. It is considering a bid of $163 million and would like to evaluate its chances of winning the upcoming auction with this bid.

a. Construct a spreadsheet simulation model for this auction. Use a discrete uniform distribution between the minimum and maximum number of bidders in the 10 observed auctions to model the number of bidders in the Jackson Pollock auction. Fit a realistic distribution to the bid data to generate values of competing bid amounts. Use ASP to apply simulation optimization to determine the hedge fund's bid amount that maximizes the expected return = P(winning auction)*(185 - bid amount). Hint: Placing reasonable bounds on the highest and lowest possible bid amount will greatly assist the optimization algorithm.

a. Construct a spreadsheet simulation model for this auction. Use a discrete uniform distribution between the minimum and maximum number of bidders in the 10 observed auctions to model the number of bidders in the Jackson Pollock auction. Fit a realistic distribution to the bid data to generate values of competing bid amounts. Use ASP to apply simulation optimization to determine the hedge fund's bid amount that maximizes the expected return = P(winning auction)*(185 - bid amount). Hint: Placing reasonable bounds on the highest and lowest possible bid amount will greatly assist the optimization algorithm.

b. What is the probability that the hedge fund wins the auction if it bids the amount that maximizes its expected return?

Definitions:

Voidable

describes a contract or transaction that is valid and enforceable on its face, but may be deemed void by one or more of the parties due to certain conditions.

Disaffirm

The act of rejecting, denying, or voiding a contract or agreement, especially one entered into by a minor or under conditions that render it voidable.

Age Of Majority

The legal age at which an individual is considered legally competent to consent to contracts and manage personal affairs; varies by country, generally 18 or 21 years old.

Emancipated

Refers to a minor who has been legally freed from control by their parents or guardians, obtaining adult rights and responsibilities.

Q1: Consider a decision situation with four possible

Q5: The outcome of a simulation experiment is

Q5: Standard precautions to prevent transmission of HIV

Q6: The patient has a temperature of 38.9°

Q8: Patients should not be given sulfonamides if

Q10: A patient is on a medication that

Q18: Which of the following is true of

Q19: When information is reported by the patient,it

Q31: Chance nodes are<br>A) nodes provided at the

Q57: Solving nonlinear problems with local optimal solutions