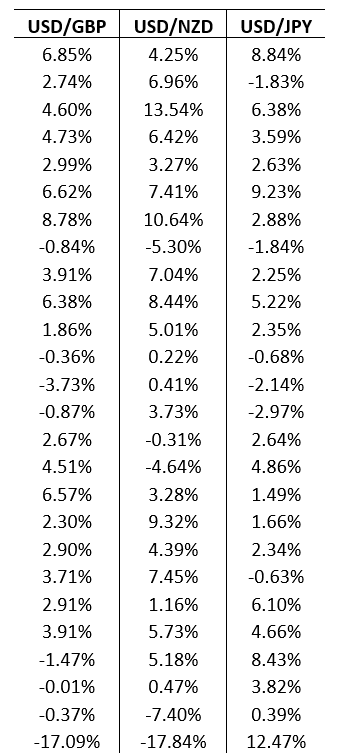

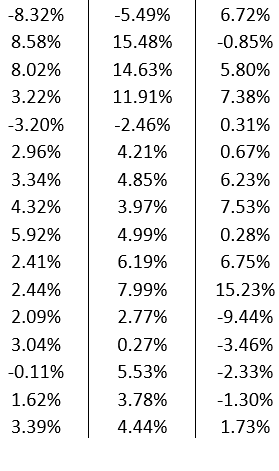

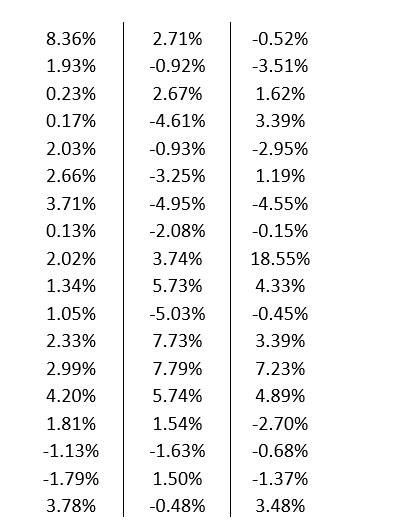

A branded store has outlets around the world that generates profit in the British pound, the New Zealand kiwi, and the Japanese yen. At the end of each quarter, the store converts the revenue from these three international outlets back into U.S. dollars, exposing itself to exchange rate risk. The current exchange rates are US$1.56 per £1, US$0.85 per NZD$1, and US$0.02 per ¥1. The management of the store wants to construct a simulation model to assess its vulnerability to uncertain exchange rate fluctuations. The quarterly profits earned in British pounds, New Zealand kiwis, and Japanese yen are £150,000, NZD$200,000, and ¥9,000,000, respectively. The data is given below.

a. If exchange rates stay at their current values, what is the total quarterly profit in U.S. dollars?

b. Model the uncertainty in the quarterly changes of the exchange rates between U.S. dollars and British pounds, New Zealand kiwis, and Japanese yen using a SLURP. Use your simulation model to estimate the average total quarterly profit in U.S. dollars. What is the probability that the total quarterly profit will be lower than the answer in part a?

Definitions:

Natural Environment

The physical, chemical, and biological systems and resources that exist independently of human actions.

Sustainable Business Model

A way of operating a business that seeks to create long-term value by taking into consideration how it operates in the ecological, social, and economic environment.

Paper Products

Items made from pulp derived from wood, rags, or grasses, which can include items like paper, cardboard, and certain packaging materials.

Reliance

The act of depending or trusting in something or someone for support, help, or fulfillment of needs.

Q2: A patient states that he occasionally takes

Q2: Which of the following is an essential

Q9: In a nonlinear optimization problem:<br>A) the objective

Q13: A patient has an acute myocardial infarction.Her

Q16: The supervisor of a production company is

Q45: The change in the optimal objective function

Q48: Jim is trying to solve a problem

Q50: The part-worth for each of the attribute

Q50: The _ assumption necessary for a linear

Q54: Suppose a company supplies four of its