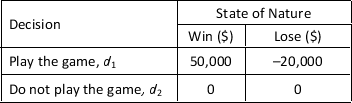

Harold has visited a casino and paid an entry fee of $20,000 to play the game of cards. Below is the payoff table in terms of the decision to play or not to play the game (Note: Harold will not pay the entry fee if he does not want to play and the below payoff table includes the entry fee):

a. In his previous visits, Harold has won 1 out of every 5 games that he has played. Use the expected value approach to recommend a decision.

a. In his previous visits, Harold has won 1 out of every 5 games that he has played. Use the expected value approach to recommend a decision.

b. Assume that the utilities for 50,000 and -20,000 are 10 and 0, respectively. If a particular decision maker assigns an indifference probability of 0.0001 to the $0 payoff, would Harold play the game? Use expected utility to justify your answer.

Definitions:

Personal/Rental

Pertaining to property that is used for personal purposes at times and rented out at others, often affecting tax implications.

Schedule E

Schedule E is a form used for tax filing that reports supplemental income and loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests.

Schedule D

A form used with the U.S. federal income tax return to report capital gains and losses from the sale, exchange, or disposition of capital assets.

Mortgage Interest

The interest charged on a loan used to purchase a residence, which can be deductible for taxpayers who itemize deductions on their income tax returns.

Q7: Which of the following is true of

Q8: In instructing a patient about corticosteroid therapy,the

Q9: The Roman numeral XLII should be interpreted

Q11: A young female patient is diagnosed with

Q13: The nurse is teaching a patient about

Q14: The worksheet formulation for integer linear programs

Q20: A bank wants to understand better the

Q23: A constraint involving binary variables that does

Q23: Which of the following data patterns best

Q28: ROFiL Pizza Delivery is planning to open