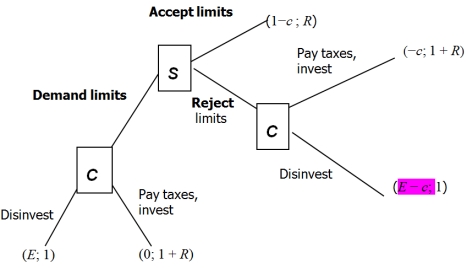

Above is the Exit, Voice, and Loyalty game between the state (S) and the citizen (C). E is what the citizen gets from her exit option. R is what the state gets from the support (revenue) of the citizen. 0 is what the citizen gets for remaining loyal to the state. c is the cost for the citizen of exercising her voice option.

Above is the Exit, Voice, and Loyalty game between the state (S) and the citizen (C). E is what the citizen gets from her exit option. R is what the state gets from the support (revenue) of the citizen. 0 is what the citizen gets for remaining loyal to the state. c is the cost for the citizen of exercising her voice option.

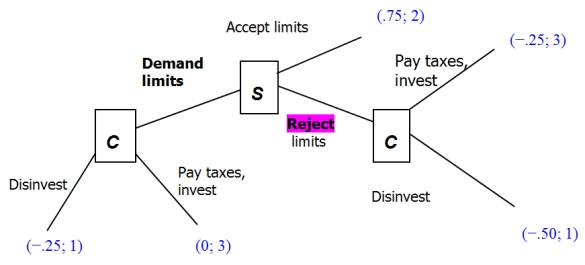

For the following questions, let R =2. Let c = 0.25.

-Now let E = −.25. . Write the payoffs for both actors in the game above. What is the subgame perfect equilibrium? Please answer in the form (citizen's 1st choice, citizen's 2nd choice; state's choice).

Definitions:

Contrarian Approach

An investment strategy that involves going against prevailing market trends or sentiments, buying underperforming assets, and selling when they perform well.

Abnormal Returns

Returns on a security that exceed or fall below what is anticipated based on market or model predictions, often attributed to unexpected events.

Macroeconomic Event

A large-scale economic occurrence affecting the economy as a whole, such as inflation, unemployment, or a recession.

Market Decline

A period in which stock prices fall across the majority of the market, often leading to a decrease in investor confidence.

Q3: Which technology can improve how employees who

Q6: Suicide was most likely in Protestant societies

Q9: Which source of information do B2B buyers

Q10: Which of the following is not one

Q15: A channel of distribution is a path

Q16: Democracy-Dictatorship classifies countries as democracies or dictatorships.

Q20: Given the preference orderings listed above, what

Q23: In which system(s) is the government responsible

Q28: A valid argument is<br>A) one where the

Q39: If an incoming government must face a