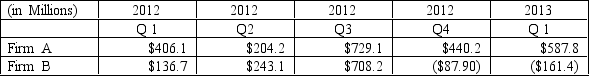

The quarterly cash flows from operations for two computer companies are as follows:

Required:

1)Explain why Firm B has more credit risk than Firm A.

2)Suppose that Firm B's cash flow was $200 million higher each quarter.Explain why Firm B might still be viewed as having higher credit risk than Firm A.

Definitions:

Net Income

The net income is the final amount of profit a company makes after deducting all costs, taxes, and expenses from its total revenue.

Capital Balances

The amount of money that owners have invested in a firm plus any retained earnings or minus any losses.

Income Ratio

A metric used to assess the profitability of a company, often calculated as net income divided by total revenues or sales.

Unlimited Life

An accounting concept referring to corporations that continue to exist irrespective of the status or continuity of their owners.

Q8: An analyst using the inventory turnover ratio

Q24: Given the information provided about Card Sharks,what

Q36: If the firm competes in a very

Q40: Financial statement forecasts rely on additivity within

Q41: The two most popular discounted earnings models

Q51: Caraway Company's net accounts receivable was $300,000

Q61: Compute the value of Jarrett Corp.on January

Q81: At an interest rate of 3%,what is

Q92: An inventory pricing procedure in which the

Q102: Suppose you purchase a bond with a