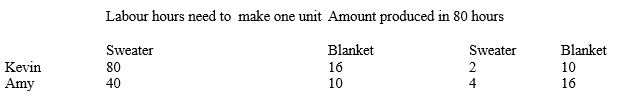

Table 3-3

-Refer to Table 3-3.How could Kevin and Amy both benefit

Definitions:

Informational Returns

Tax documents used to report certain types of transactions to the IRS, including income, interest, dividends, but not directly tax-deductible amounts.

Straight-Line Method

A method of calculating depreciation for accounting purposes, allocating a uniform expense amount to each year of an asset's useful life.

Depreciated

A decrease in the value of an asset over time, often due to wear and tear or obsolescence, which can be used for tax deductions.

Primarily Personal Property

Items or assets that are mainly used for personal, non-business purposes, which may include vehicles, furniture, and electronics.

Q11: The only two countries in the world,

Q20: Refer to the Figure 4-4. If the

Q58: The country of Econoland produces two goods:textbooks

Q90: Suppose that demand increases and supply decreases.

Q108: How can trade benefit a family?<br>A) by

Q109: Assume that Spain has a comparative advantage

Q119: Refer to Table 3-3. How could Kevin

Q137: For two people who are planning to

Q139: What was inflation in Canada in the

Q195: What is another name for goods and