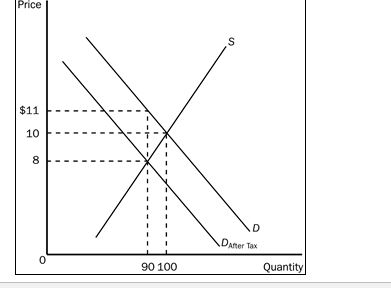

Using the graph shown,answer the following questions.

a.What was the equilibrium price in this market before the tax?

b.What is the amount of the tax?

c.How much of the tax will the buyers pay?

d.How much of the tax will the sellers pay?

e.How much will the buyer pay for the product after the tax is imposed?

f.How much will the seller receive after the tax is imposed?

g.As a result of the tax, what has happened to the level of market activity?

Definitions:

Positioning Method

The strategy used by a company to differentiate its products or services from its competitors' and to occupy a specific place in the minds of the target market.

Perceptual Map

A visual representation of how consumers perceive and position products, brands, or companies relative to each other, typically based on important attributes.

Target Market

A specific group of consumers at which a company aims its products and services, identified through various factors like demographics, behaviors, and preferences.

Differentiated Targeting Strategy

A marketing approach where a company targets multiple market segments with specific products or marketing campaigns designed to meet the unique needs of each segment.

Q27: A binding minimum wage in a competitive

Q39: If a price ceiling is not binding,it

Q49: Refer to Figure 8-5.Without a tax,producer surplus

Q70: Refer to Figure 6-9.How much tax revenue

Q72: Refer to Figure 8-5.What happens to producer

Q167: Refer to Figure 5-8.Using the midpoint method,between

Q173: The income elasticity of demand is defined

Q228: Refer to Figure 8-2.The per unit burden

Q235: Which of the following is the most

Q277: For which of the following types of