Use the table for the question(s) below.

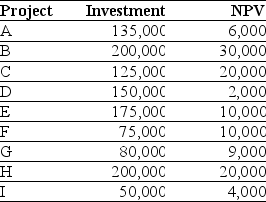

Consider the following list of projects:

-Assume that your capital is constrained,so that you only have $500,000 available to invest in projects.If you invest in the optimal combination of projects given your capital constraint,then the total net present value (NPV) for all the projects you invest in will be closest to:

Definitions:

Market Portfolio

A portfolio consisting of a mix of all available investments in the market, weighted by market value, which represents the entire stock market or a particular segment of it.

Risk Aversion

The tendency of investors to avoid unnecessary risk, preferring safer investments over riskier ones for the same expected return.

Capital Asset Pricing

A model that describes the relationship between the expected return of an investment and the risk, or beta, relative to the market.

Systematic Risk

The risk inherent to the entire market or market segment, which cannot be mitigated through diversification.

Q18: What is the ultimate goal of the

Q33: The yield to maturity for the two-year

Q40: A textile company invests $12 million in

Q50: Valence Electronics has 217 million shares outstanding.It

Q60: The S&P TSX Composite index delivered annual

Q65: Which of the following bonds will be

Q66: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1618/.jpg" alt=" The yields to

Q86: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1618/.jpg" alt=" Based on Figure

Q93: A bond has a $1000 face value,ten

Q101: What is the expected payoff for Big