Use the information for the question(s) below.

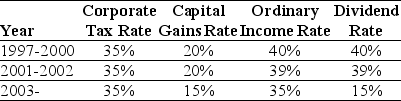

Consider the following tax rates:

-In 2006,Luther Incorporated paid a special dividend of $5 per share for the 1 million shares outstanding.If Luther has instead retained that cash permanently and invested it into Treasury bills earning 6%,then the present value (PV) of the additional taxes paid by Luther would be closest to:

Definitions:

Extraversion

A personality trait characterized by outgoingness, high energy, and a preference for social interaction.

Agreeableness

A personality trait that reflects the extent of a person's warmth and kindness towards others.

Empirically Validated

Confirmed or supported by observational and experimental evidence.

Superego

A component of Freud's psychoanalytic theory, representing the moral conscience and the internalization of societal norms and principles.

Q19: A firm has $70 million in equity

Q19: Omicron's enterprise value is closest to:<br>A) $500

Q24: Why is EBITDA multiple used for valuation

Q38: The amount of cash a firm is

Q44: What are the three reasons why a

Q45: _ is the amount of additional external

Q51: In which of the following situations does

Q71: Suppose Blank Company has only one project,as

Q78: Assume that management makes a surprise announcement

Q80: Based upon Ideko's sales and operating cost