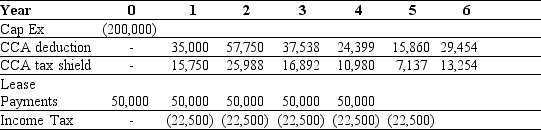

Use the table for the question(s) below.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

-If your firm's borrowing cost is 3% and the tax rate is 45%,what is the NPV of buying and leasing?

Definitions:

Quick Response

A business strategy aimed at decreasing lead times and enhancing flexibility in operations to meet customer demand efficiently.

Manufacturer Profit

The financial gain a manufacturing company secures from its operations after deducting costs associated with production and distribution.

Short Term

A period of time that is immediate or not far in the future, usually less than a year, often used in reference to planning or financial strategies.

Product Availability

the extent to which a product is obtainable in the desired quantities at the right time and place for customers.

Q27: The results of backward conditioning experiments demonstrate

Q27: After the Irish taxes are paid,the amount

Q37: What are Blunderstone's temporary working capital requirements

Q52: Which of the following companies is most

Q57: The spot exchange rate for Indian rupees

Q58: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1618/.jpg" alt=" Suppose oil futures

Q68: A firm issues four-month commercial paper with

Q74: Which of the following would most likely

Q84: A firm issues six-month commercial paper with

Q85: What is permanent working capital?<br>A) the amount