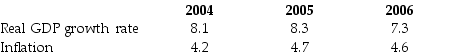

Use the table below to answer the following question.

Table 26.3.2

-Refer to Table 26.3.2. The International Monetary Fund's World Economic Outlook database provides the data given in the table for India in 2004, 2005 and 2006. The numbers in the table are consistent with

Definitions:

Sarcomere

The basic contractile unit of muscle fiber, consisting of actin and myosin filaments between two Z-lines in striated muscle cells.

T Tubule

Tubular extensions of the plasma membrane in muscle cells that facilitate the uniform contraction of the muscle by spreading electrical impulses.

Myosin

A protein that, along with actin, enables muscular contraction and movement in animal cells.

Serotonin

A neurotransmitter that is involved in the regulation of mood, sleep, appetite, and pain perception.

Q4: Which of the following is an example

Q9: If the economy's capital decreases over time,<br>A)net

Q23: Choose the statement that is incorrect.<br>A)A chartered

Q34: If aggregate planned expenditure is less than

Q52: Choose the statement that is incorrect.<br>A)Fractional-reserve banking

Q75: In Table 27.1.3, at which of the

Q123: Suppose that the desired reserve ratio is

Q135: In Figure 27.2.3, autonomous expenditure is<br>A)$10 billion.<br>B)$100

Q152: If aggregate planned expenditure exceeds real GDP

Q170: Consumption expenditure minus imports, which varies with