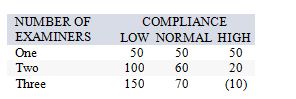

The local operations manager for the Internal Revenue Service must decide whether to hire one, two, or three temporary tax examiners for the upcoming tax season. She estimates that net revenues (in thousands of dollars) will vary with how well taxpayers comply with the new tax code just passed by Congress, as follows:  If she feels the chances of low, medium, and high compliance are 20 percent, 30 percent, and 50 percent respectively, what are the expected net revenues for the number of assistants she will decide to hire?

If she feels the chances of low, medium, and high compliance are 20 percent, 30 percent, and 50 percent respectively, what are the expected net revenues for the number of assistants she will decide to hire?

Definitions:

Labor Price Variance

The difference between the actual cost of direct labor and the standard cost, typically associated with the rate paid for labor.

Labor Quantity Variance

The difference between the actual hours worked and the standard hours expected, multiplied by the standard hourly wage rate.

Standard Costing System

A cost accounting system that assigns predetermined costs to products and services, used to plan budgets and assess performance by comparing actual costs against these standards.

Total Price Variance

The difference between the actual cost of a good or service and its expected cost based on standard pricing.

Q1: Predetermined time standards involve the use of

Q7: Location choice I has monthly fixed costs

Q14: Where a firm locates would typically not

Q17: Which of the following is the most

Q40: Quality function deployment is a structured approach

Q57: In the area of product and service

Q58: A manager uses the following equation to

Q72: Given forecast errors of 4, 8, and

Q75: Operation X feeds into operation Y. Operation

Q94: Determining the average payoff for each alternative