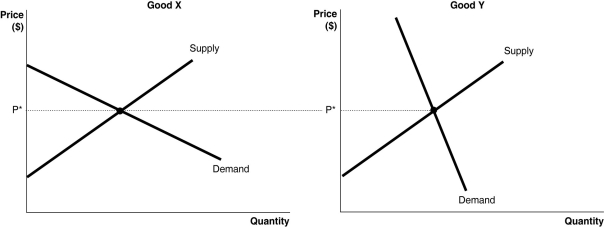

Figure 4-11

-Refer to Figure 4-11.The figure above illustrates the markets for two goods, Good X and Good Y.Suppose an identical dollar tax is imposed on sellers in each market.

a.Compare the consumer burden and producer burden in each market.Illustrate your answer graphically.

b.If the goal of the government is to raise revenue with minimum impact to quantity consumed, in which market should the tax be imposed?

c.If the goal of the government is to discourage consumption, in which market should the tax be imposed?

Definitions:

Double Time

A rate of pay that is twice the standard rate, often paid for overtime work.

Time and a Half

A rate of pay that is 1.5 times the employee's regular hourly rate, often paid for overtime work.

OASDI

An acronym for Old-Age, Survivors, and Disability Insurance, a comprehensive federal benefits program in the United States that provides retirement, disability, and survivors benefits.

Hospital Insurance

A type of insurance coverage that pays for medical and surgical expenses incurred by the insured in a hospital setting, often part of broader health insurance plans.

Q55: Refer to Figure 4-5.Suppose that instead of

Q72: Refer to Figure 5-4.What does S₁ represent?<br>A)the

Q89: Auctions in recent years have resulted in

Q136: Refer to Table 4-4.If a minimum wage

Q143: In 18th century Europe, governments gave guilds

Q155: A tax that imposes a small excess

Q175: Rent control is an example of<br>A)a subsidy

Q204: Consumers are willing to purchase a product

Q210: Which of the following statements is true?<br>A)Whenever

Q283: A linear downward-sloping demand curve has price