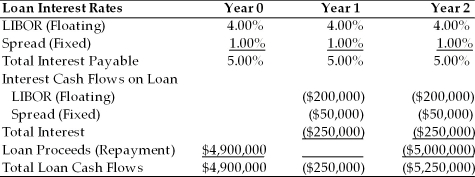

TABLE 15.1

Use the information for Polaris Corporation to answer following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer Table 15.1. If the LIBOR rate falls to 3.00% after the first year what will be the all-in-cost (i.e. the internal rate of return) for Polaris for the entire loan?

Definitions:

Personal Connections

Relationships or networks formed between individuals based on mutual interests, shared values, or professional affiliations.

Foreign Currency Valuations

The process of determining the value of foreign currencies in comparison to one's own currency for financial reporting and trading.

Globalizing Operations

The process of expanding business operations across international borders, aiming for a global presence and market.

Individualism

A cultural orientation in which people belong to loose social frameworks and their primary concern is for themselves and their families.

Q2: The Russian Ruble crisis of 1998 was

Q2: Refer to Table 15.1. What is the

Q8: A/An _ is a locally incorporated bank

Q11: It is safe to say that most

Q12: An Edge Act corporation is a subsidiary

Q22: If the European subsidiary of a U.S.

Q25: A foreign currency _ option gives the

Q36: _ volatility are calculated by being backed

Q37: The optimal capital budget<br>A) occurs where the

Q87: The best technology is:<br>A) the technology that