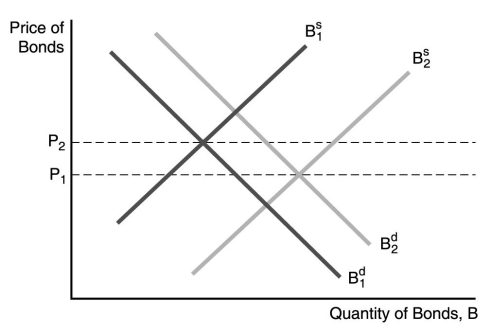

-In the figure above, the price of bonds would fall from P₂ to P₁ if ________.

Definitions:

Expected Returns

The profit or loss an investor anticipates on an investment that has various known or predictable rates of return.

Standard Deviation

A statistical measure of the dispersion or variability in a set of data points, often used in finance to quantify the volatility of an investment.

Return

The increase or decrease in value of an investment during a set period, represented as a percentage of the investment's starting price.

S&P/TSX Composite Index

A market index representing the performance of the Canadian stock market, compiled by the Standard & Poor’s company.

Q3: Corporate bonds are not as liquid as

Q19: Evidence in support of the efficient markets

Q26: A disadvantage of _made from precious metals

Q57: The preferred habitat theory of the term

Q58: Which of the following is NOT one

Q69: Using the one-period valuation model,assuming a year-end

Q71: New information that might lead to a

Q95: Because of an expected rise in interest

Q103: Which of the following is NOT a

Q132: Banks that suffered significant losses in the