Match the title with its responsibility.

Definitions:

Tax Rate Change

An adjustment in the percentage at which an individual or corporation is taxed, affecting the computation of tax liabilities and net income.

Temporary Difference

A difference between the book value and tax value of an asset or liability that will result in taxable or deductible amounts in future years.

Accrued Product Warranty

Liabilities recognized for future costs related to warranty claims on products sold that have not yet been serviced.

Taxable Income

The amount of income that is used to calculate an individual's or a company's income tax dues, calculated as gross income minus deductions and exemptions.

Q4: Outsourcing an IT infrastructure will always save

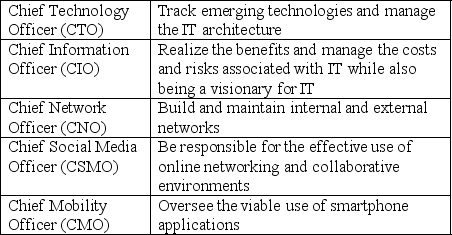

Q11: Match the organization with the IT governance

Q14: For which of the following countries is

Q17: Bostwana and Uganda,Chad and Niger

Q18: A company that seeks an IT portfolio

Q20: Washington Consensus,1990 World Development Report

Q24: IT governance has two major components: the

Q24: Pareto optimality,aid to the poor

Q43: Review the description of 3 different IT

Q58: Avon uses this to monitor the status