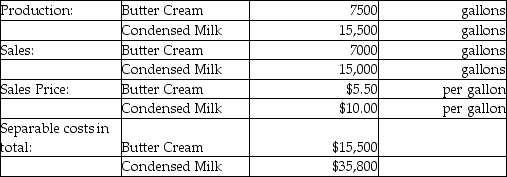

The Kenton Company processes unprocessed milk to produce two products, Butter Cream and Condensed Milk. The following information was collected for the month of June:

Direct Materials processed:23,000 gallons (after shrinkage)

The cost of purchasing the of unprocessed milk and processing it up to the split-off point to yield a total of 23,000 gallons of saleable product was $48,000.

The company uses constant gross-margin percentage NRV method to allocate the joint costs of production. Which of the following statements is true of Kenton's joint cost allocations?

Definitions:

Depreciation Expense

An accounting method for allocating the cost of a tangible asset over its useful life, representing the asset's consumption, wear and tear, or obsolescence.

Straight-Line Method

The straight-line method is a depreciation technique that allocates an equal amount of depreciation expense for a fixed asset to each year of its useful life.

Salvage Value

The estimated market valuation of an asset following the end of its useful duration.

Depreciation Expense

The charge to the income statement for a particular period that represents the allocation of the cost of tangible assets over their useful lives.

Q11: When a unit has to be reworked,

Q26: Costs in a homogeneous cost pools have

Q34: Explain the importance of customer-profitability analysis.

Q49: Spoilage and rework costs are thoroughly captured

Q52: Relevant-cost and relevant-revenue analysis uses the allocated

Q98: When using the cause-and-effect criterion, cost drivers

Q136: Which of the following best describes conformance

Q142: A financial analyst for Simon Manufacturing prepared

Q142: The Brital Company processes unprocessed milk to

Q162: Using the fairness criterion, the costs are