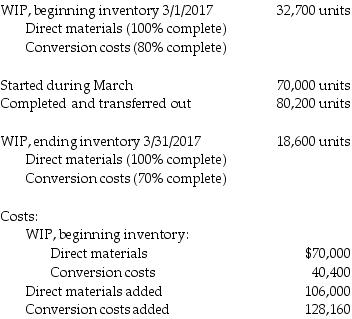

Verer Custom Carpentry manufactures chairs in its Processing Department. Direct materials are included at the inception of the production cycle and must be bundled in single kits for each unit. Conversion costs are incurred evenly throughout the production cycle. Inspection takes place as units are placed into production. After inspection, some units are spoiled due to undetectable material defects. Spoiled units generally constitute 4% of the good units. Data provided for March 2017 are as follows:

What costs would be associated with normal and abnormal spoilage, respectively, using the FIFO method of process costing? (Round any cost per unit calculations to the nearest cent.)

Definitions:

Fixed Manufacturing Overhead

Costs associated with the production process that do not change with the level of output, such as rent, salaries, and utility expenses.

Production Volume

The total number of units of a product or service produced over a specific period.

Sales Volume

The total number of units of product sold during a specific period.

Variable Costing

A costing method that includes only variable costs—direct materials, direct labor, and variable manufacturing overhead—in the cost of a product.

Q3: Sodius Chemical Inc. placed 220,000 liters of

Q20: Timekeeper Inc. manufactures clocks on a highly

Q54: Normal spoilage costs are usually deducted from

Q81: The fixed costs of operating the maintenance

Q103: The Zeron Corporation wants to purchase a

Q131: Which of the following is an example

Q132: Without financial quality measures, _.<br>A) customer satisfaction

Q135: The Duolane Pottery manufactures pottery products. All

Q137: The following information applies to Krynton Corp.

Q138: Buzz's Educational Software Outlet sells two or