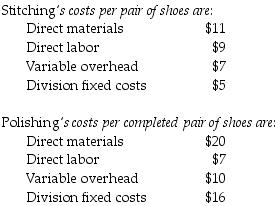

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $50. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-103,000 units. The fixed costs for the Polishing Division are assumed to be $22 per pair at 103,000 units.

Calculate and compare the difference in overall corporate net income of Branded Shoe Company between Scenario A and Scenario B if the Assembly Division sells 103,000 pairs of shoes for $120 per pair to customers.

Scenario A: Negotiated transfer price of $33 per pair of shoes

Scenario B: Market-based transfer price

Definitions:

Bailed Goods

Items that are temporarily handed over to someone else for custody or care, often with the expectation of return.

Conversion

The unauthorized possession or control over someone else's property, converting it for one's own use.

Possession

The act of having control over an object or property, with or without legal ownership.

Bailment

The temporary placement of control over, or possession of personal property by one person, the bailor, into the hands of another, the bailee, for a specific purpose.

Q11: Among different types of costs associated with

Q19: Which of the following is an example

Q22: Which of the following is true of

Q42: Craylon Corp has three divisions, which operate

Q55: Which of the following is true of

Q86: Managing inventories to increase net income requires

Q88: In situations where the required rate of

Q126: Tax deductions for depreciation result in tax

Q138: The optimal safety-stock level is the quantity

Q149: Branded Shoe Company manufactures only one type