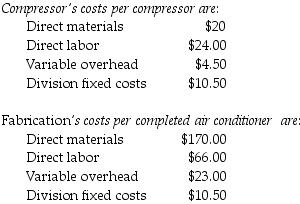

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $42.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 12,000-17,000 units. The fixed costs for the Fabrication Division are assumed to be $8.00 per unit at 17,000 units.

Assume the transfer price for a compressor is 145% of total costs of the Compressor Division and 1500 of the compressors are produced and transferred to the Fabrication Division. The Compressor Division's operating income is ________.

Definitions:

Serous Membrane

Thin sheet composed of epithelial and connective tissues; it lines cavities that do not open to the outside of the body or contain glands but do secrete serous fluid.

Salivary Amylase

An enzyme found in saliva that initiates the breakdown of starches into simpler sugars during digestion.

Salivary Glands

Exocrine glands in the mouth that produce saliva, aiding in digestion and helping maintain oral health.

Gastric Lipase

An enzyme secreted by the stomach that plays a critical role in the digestion of dietary fats.

Q3: Which of the following statements best defines

Q46: The tariffs and customs duties governments levy

Q47: Just-in-time purchasing describes the flow of goods,

Q48: The economic order quantity model completely ignores

Q69: Some companies present financial and nonfinancial performance

Q71: Batman Abstract Company has three divisions that

Q111: Identifying and minimizing the sources of non-value-added

Q111: When companies do not want to use

Q111: _ would be an uncontrollable factor that

Q115: Plish Company manufactures only one type of