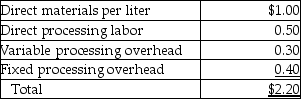

Olive Branch Company recently acquired an olive oil processing company that has an annual capacity of 2,000,000 liters and that processed and sold 1,400,000 liters last year at a market price of $4 per liter. The purpose of the acquisition was to furnish oil for the Cooking Division. The Cooking Division needs 800,000 liters of oil per year. It has been purchasing oil from suppliers at the market price. Production costs at capacity of the olive oil company, now a division, are as follows:

Management is trying to decide what transfer price to use for sales from the newly acquired company to the Cooking Division. The manager of the Olive Oil Division argues that $4, the market price, is appropriate. The manager of the Cooking Division argues that the cost of $2.14 should be used, or perhaps a lower price, since fixed overhead cost should be recomputed with the larger volume. Any output of the Olive Oil Division not sold to the Cooking Division can be sold to outsiders for $4 per liter.

Required:

a.Compute the operating income for the Olive Oil Division using a transfer price of $4.

b.Compute the operating income for the Olive Oil Division using a transfer price of $2.20.

c.What transfer price(s) do you recommend? Compute the operating income for the Olive Oil Division using your recommendation.

Definitions:

Group Assignment

A task or project given to a set of individuals intended to be worked on in collaboration, often used in educational settings to build teamwork skills.

Participants

Individuals who take part in a research study or experiment.

Random Sample

A subset of individuals randomly selected from a population, intended to represent the whole population in research studies.

Class

A group of students who are taught together in a school or college, or the meeting during which they are taught.

Q18: "Levers of control," in addition to a

Q22: Forise Water Company drills small commercial water

Q23: A patient had a 1:00 pm appointment

Q35: What are the strengths and weaknesses of

Q52: A company which favors the residual income

Q56: Timekeeper Corporation has two divisions, Distribution and

Q76: Waldorf Company has two sources of funds:

Q109: Home Decor Inc., manufactures home cleaning products.

Q125: The accounting procedures in a backflush-costing system

Q128: In the "obtain information" stage of capital