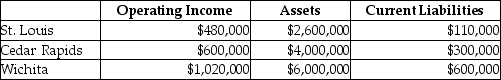

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,200,000 issued at an interest rate of 13%, and equity capital that has a market value of $4,200,000 (book value of $2,400,000) . Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 13%, while the tax rate is 35%.

What is the EVA® for St. Louis? (Round intermediary calculations to four decimal places.)

Definitions:

Q7: Olive Branch Company recently acquired an olive

Q40: An additional criticism of team-based compensation is

Q60: The Enor Machine Company is evaluating a

Q60: Waldorf Company has two sources of funds:

Q82: Beryl Company sells 900 flash drives per

Q93: In an EVA calculation, the appropriate measure

Q104: The focus in capital budgeting should be

Q110: The internal rate of return method assumes

Q125: Negotiated transfer prices are often employed when

Q143: Aerated Water Company makes internal transfers at