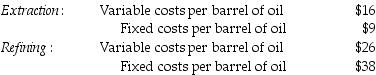

Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,900 barrels a day and usually purchases 25,600 barrels of oil from the Extraction Division and 15,400 barrels from other suppliers at $64 per barrel.

Assume 260 barrels are transferred from the Extraction Division to the Refining Division for a transfer price of $26 per barrel. The Refining Division sells the 260 barrels at a price of $220 each to customers. What is the operating income of both divisions together?

Definitions:

Enter Credit Card Charges

The process of recording the expenses incurred on a business credit card into the company's accounting system.

Business Transaction

Any activity that involves the exchange of goods, services, or funds between two or more parties.

QuickBooks Company

A specific business entity set up within QuickBooks accounting software to manage its financial transactions and records.

Onscreen Journal

A digital ledger displayed on a screen, used to record financial transactions in accounting software.

Q2: Which of the following describes boundary control

Q19: Inflation clouds the real economic returns on

Q21: The three common discounted cash flow methods

Q25: The Allianz Company produces a specialty wood

Q29: One concern with dual pricing is that

Q62: Which of the following costs is a

Q71: When cost-based transfer pricing is used between

Q86: Brown Laundry has a variable demand. The

Q95: Which of the following statements best defines

Q129: Which of the following is a difference