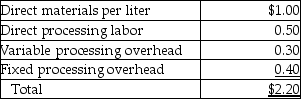

Olive Branch Company recently acquired an olive oil processing company that has an annual capacity of 2,000,000 liters and that processed and sold 1,400,000 liters last year at a market price of $4 per liter. The purpose of the acquisition was to furnish oil for the Cooking Division. The Cooking Division needs 800,000 liters of oil per year. It has been purchasing oil from suppliers at the market price. Production costs at capacity of the olive oil company, now a division, are as follows:

Management is trying to decide what transfer price to use for sales from the newly acquired company to the Cooking Division. The manager of the Olive Oil Division argues that $4, the market price, is appropriate. The manager of the Cooking Division argues that the cost of $2.14 should be used, or perhaps a lower price, since fixed overhead cost should be recomputed with the larger volume. Any output of the Olive Oil Division not sold to the Cooking Division can be sold to outsiders for $4 per liter.

Required:

a.Compute the operating income for the Olive Oil Division using a transfer price of $4.

b.Compute the operating income for the Olive Oil Division using a transfer price of $2.20.

c.What transfer price(s) do you recommend? Compute the operating income for the Olive Oil Division using your recommendation.

Definitions:

Small Business Administration (SBA)

The Small Business Administration (SBA) is a U.S. government agency that provides support to entrepreneurs and small businesses, including financial assistance, counseling, and training programs.

Real Estate Broker

A licensed individual or firm that acts as an intermediary between buyers and sellers of real estate properties, often earning a commission for facilitating transactions.

FTC

The Federal Trade Commission, a U.S. government agency focused on consumer protection and maintaining competition.

Estate Settlement

The process of managing and distributing a deceased person's assets according to their will or state laws if there is no will.

Q16: The River Falls Company has two divisions.

Q28: The tool crib at a large manufacturing

Q33: Coptermagic Company supplies helicopters to corporate clients.

Q41: The following information applies to Krynton Corp.

Q53: Which of the following correctly describes manufacturing

Q65: The net present value method accurately assumes

Q72: Tornado Electronics manufactures stereos. All processing is

Q104: Decisions regarding sources of long-term financing are

Q112: The Cybertronics Corporation reported the following information

Q129: The Controller of Nip-it-in-the-Bud Inc. has studied