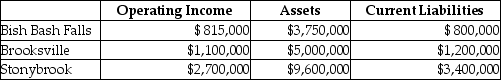

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $17,000,000 issued at an interest rate of 11%, and equity capital that has a market value of $6,000,000 (book value of $5,500,000) . Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 35%.

What is the EVA® for Stonybrook? (Round intermediary calculations to four decimal places.)

Definitions:

Service Quality Evaluation

The assessment process of determining the quality of services provided, often involving measures of customer satisfaction, service performance, and compliance with standards.

Performance Perceptions

How the quality, efficiency, or value of someone's work or a product is viewed or assessed by others.

Service Expectations

The anticipated level of service performance and quality that customers expect from a provider.

Prevention Costs

The expenses involved in avoiding defects in products or services, including costs related to quality planning and training.

Q9: Stonex Corp, whose tax rate is 35%,

Q20: Decentralization in multinational companies may lead to

Q38: Companies are increasingly using nonfinancial measures to

Q43: Effort refers to physical exertion, such as

Q58: Diemia Hospital has been considering the purchase

Q60: The Enor Machine Company is evaluating a

Q66: Comparison of the actual results for a

Q95: The Ambitz Corporation has an annual cash

Q105: Which of the following statements is true

Q106: Transfer-pricing systems enable managers to focus on