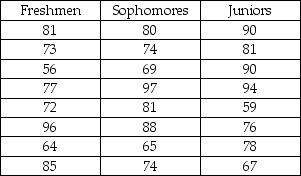

THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

Random samples of eight freshmen,eight sophomores,and eight juniors taking a business statistics class were drawn.The accompanying table shows scores on the final examination.

-Carry out a nonparametric test of the null hypothesis of equality of population mean examination scores for freshman,sophomore,and juniors.Use α = 0.05.

Definitions:

ROE

Return On Equity represents a financial performance metric that is obtained by dividing a company's net income by its shareholders' equity, demonstrating the company's effectiveness in using investor funds to grow earnings.

EPS

Earnings Per Share, a key indicator of a company's profitability, calculated by dividing the company's net income by its total number of outstanding shares.

DFL

Degree of Financial Leverage, a ratio measuring the sensitivity of a company's earnings per share to fluctuations in its operating income, due to changes in its capital structure.

Optimal Capital Structure

The most favorable blend of debt and equity financing that minimizes a company's cost of capital while maximizing its market value.

Q4: Keeping up with technological advances is an

Q8: Can anyone enter into a business contract?

Q10: Diversity initiatives in businesses are essential to

Q39: In 2010,U.S.businesses spent _ on advertising.<br>A) $279

Q51: An Old Navy store is an example

Q54: Test the model for heteroscedasticity.

Q63: The range of the values of the

Q74: Which of the following poses the MOST

Q182: In an ANOVA analysis with K number

Q191: Test at the 10% level of significance