THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

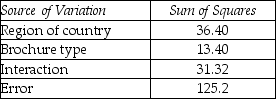

A sales manager is interested in evaluating the effectiveness of product literature.There are five different types of brochures currently in use.He asks four salespeople in each of the four regions of the country to evaluate the effectiveness of each of the brochures.The results of a two-way ANOVA are presented below.

-Is there sufficient evidence to reject the null hypothesis that there is no difference between the regions of the country? Use α = 0.05.

Definitions:

Capital Asset Pricing Model

A theory detailing how systematic risk correlates with the expected return for investments, mainly in the stock market.

Stock Correlation

A statistical measure that describes how the movements of two stocks are related to each other.

Risky Assets

Assets that carry a significant degree of risk of loss, often associated with higher potential returns as compensation for the risk taken.

Market Risk Premium

The extra return over the risk-free rate that investors require to compensate them for the risk of investing in the stock market.

Q19: The average for Group 1 is equal

Q43: A planned economy is one in which

Q51: An Old Navy store is an example

Q55: What are the degrees of freedom for

Q69: The normal approximation to the sign test

Q107: What is the sales forecast for the

Q110: Find a 95% confidence interval for the

Q123: Explain what is meant by heteroscedasticity.What effects

Q126: The following are the values of a

Q130: What is the forecast for the year